Switzerland’s new regulatory landscape for portfolio managers

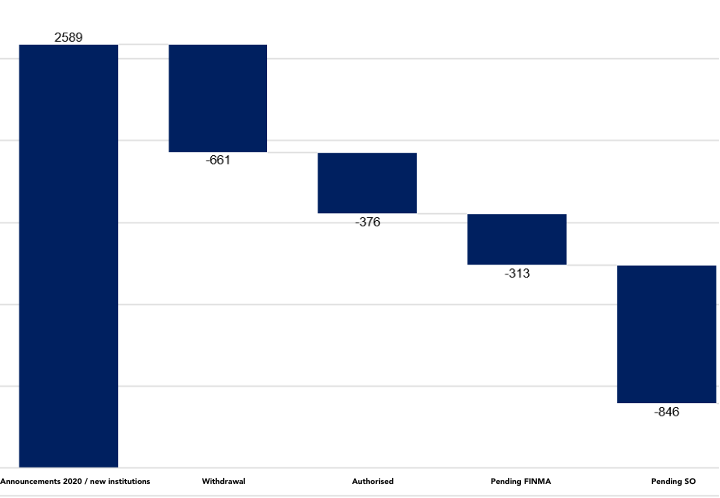

June 2022 was an important date for all Swiss asset managers to submit an application for the new FINMA license. Those who had submitted their application by then, have a good chance of being approved by the end of the year. By then, all independent and external asset managers who were formerly a member of a Self-Regulatory-Organisation (SRO) will be subject to a single regulatory framework as "trustees" or "portfolio managers". For existing asset managers the application must have been approved by the Supervisory-Organisation (SO) first and needs to be at FINMA for the final licensing procedure by end of year, in order to remain operational. For many entities this regulatory change is disruptive due to associated costs of acquiring and maintaining a new license, as well as other business factors. This might have been the reason why 25% of companies decided not to pursue the license. [1] Such a choice is pivotal for the industry as it will trigger large scale consolidation or outsourcing of portfolio management activities, which could fundamentally restructure the asset management sector.

In this article, we recap the state of applications and how the outcomes of the new licensing could change the industry going forward.

FINMA license - key facts

In January 2020 the Financial Service Act (FinSA) and Financial Institutions Act (FinIA) came into force with the objective of harmonizing the country’s financial market architecture. By the end of 2022, portfolio managers and trustees must have submitted a license application to FINMA in order to continue their business operations without facing penalty. This requires, among other things, demonstrating their connection to a Supervisory Organization (SO) that will take over continuous supervision after FINMA has granted the license, the approval of the licence application by this SO and the transmission to FINMA for final review.

%20(1).png) |

New ordinance - the state of things

The last ordinance from FINMA published in August provided a broad overview of the current status of applications. Only 700 of the estimated 2500+ wealth managers and trustees who are subject to this new regulation did apply for a license by August 2022. Due to the complexity and hence lengthiness of the licensing process, only half of them have received FINMA approval so far.

An application is processed by FINMA in an average of 108 days and a maximum of 536 days. Organizations that still have not filed their paperwork with FINMA run the possibility of having to suspend operations at the start of 2023 while their applications are being reviewed. 846 entities had their applications still pending with SO in August, the first preliminary step of requesting the license.

|

|

The ordinance also warns the institutions on the risks they would bear have they not applied for new license in time. Missing the end of the transitional period on 31 December 2022 but continuing to operate exposes portfolio managers and trustees to supervisory law measures as well as criminal penalties. The monetary penalties or fines can be up to CHF 250,000 even in the case of negligence. A fraction of portfolio managers commenced their activities under the new licensing requirements before January 2023. Among those FINMA had already filed criminal charges with the FDF in 18 suspicious cases and had placed 127 institutions on its public warning list for carrying out unauthorized activities.

Due to high complexity of the process, high fees for application that currently range between CHF 2,000 to CHF 20,000 and other business factors, 661 institutions reported they do not intend to submit an application.

Options for non-licensed portfolio managers

One path that has evolved for non-licensed entities seeking is the outsourcing of certain activities and functions to third parties for complying with the applicable licensing requirements without incurring extensive costs. [2]

But there are other options too. 18% of the companies that decided not to pursue the license mentioned that the reason for it was a modification of the business model and 7% mentioned M&A activities.

Given that complying with the new regulatory environment frequently necessitates bigger size owing to rising expenses and governance requirements, an M&A scenario typically appears to be the safest course to pursue. Many larger companies will see this as an opportunity to buy out struggling independent rivals while smaller companies may choose to collaborate with EAMs of comparable size. Thus, it is anticipated that these new FinIA requirements will accelerate industry consolidation in the Swiss wealth management sector.

Portfolio Manager Licence and Structured Products

The license for “portfolio managers” is a prerequisite for the management of investment products, such as Actively Managed Certificates (AMC), Tracker Certificates or Credit Linked Notes, the structuring of which we offer, if they securitize more than a single asset.

If you need assistance with the license process, asset management or compliance outsourcing services or are looking for advice on managing your current or future portfolio and portfolio-based investment products, please reach out for support!

[1] FINMA Guidance 02/2022 from August 11, 2022

[2] mondaq.com