Open-end VC fund: an innovative investment vehicle

The evolution of the crypto investment space

Alternative assets, such as private equity or venture capital, hedge funds, real estate, commodities, and tangible assets, are estimated to capture a growing share in investment portfolios. McKinsey & Co estimates that during the last 10 years, global private markets tripled their fundraising, reaching an all-time high of 1,091 billion in 2019. If we only take into account pure alternative assets funds, then according to PitchBook the number of such funds almost doubled over the last decade. Despite a slight decrease in alternative investments during the beginning of the pandemic, the second quarter of 2020 was characterized by the “Covid correction recovery” comparable to one in the public markets.

Meanwhile, the wave of cryptocurrency news has analysts pondering the future of the token economy - with proponents seeing nothing short of a revolution in the economic system as we know it, and opponents, on the other hand, questioning the hype and the technology as a whole. Yet, the many assessments too often overlook a crucial point. While some coins and tokens are regularly rising and inflating, innovations in the underlying technological infrastructure are expanding so that we find an increasingly sophisticated and powerful ecosystem. With that, the number of use cases is growing, as we see for example in Decentralised Finance (DeFi). It is now possible not only to invest in Bitcoin, Ether, and Altcoins as a way of value storage but also to borrow and lend, obtain insurances or trade via decentralized marketplaces. Meanwhile, investors are flocking to fund this wave of disruption. Crypto & Blockchain Venture Funding has grown by more than 600% in the last 2 years, with a record high at $6 billion in total volume in 2021 [theblockcrypto.com]. During the same time, the market capitalization of major coins (Bitcoin and Ethereum) has increased by more than 1600% from nearly $80 billion to over $1 trillion [CoinMarketCap, 2019 till 2021], and the value locked in DeFi from $310 million to over $100 billion.

With the new fast-changing market conditions and flexibility being a primary focus in all strategic aspects, we can see a rise to more flexible (adaptable) investment vehicles. In addition to a growing number of Venture Capital (VC) funds, hedge funds, and fund of funds focusing on alternative assets and crypto investments, more special and flexible vehicles, such as actively managed certificates (AMC), credit-linked notes (CLN) and first security tokens, rapidly gain in importance. Index-like vehicles for alternative assets, like ETPs, are also increasingly entering the market, including first crypto and DeFi indices.

The rise of deep-tech disruptors and digital assets calls for new structures: Open-End VC Investments

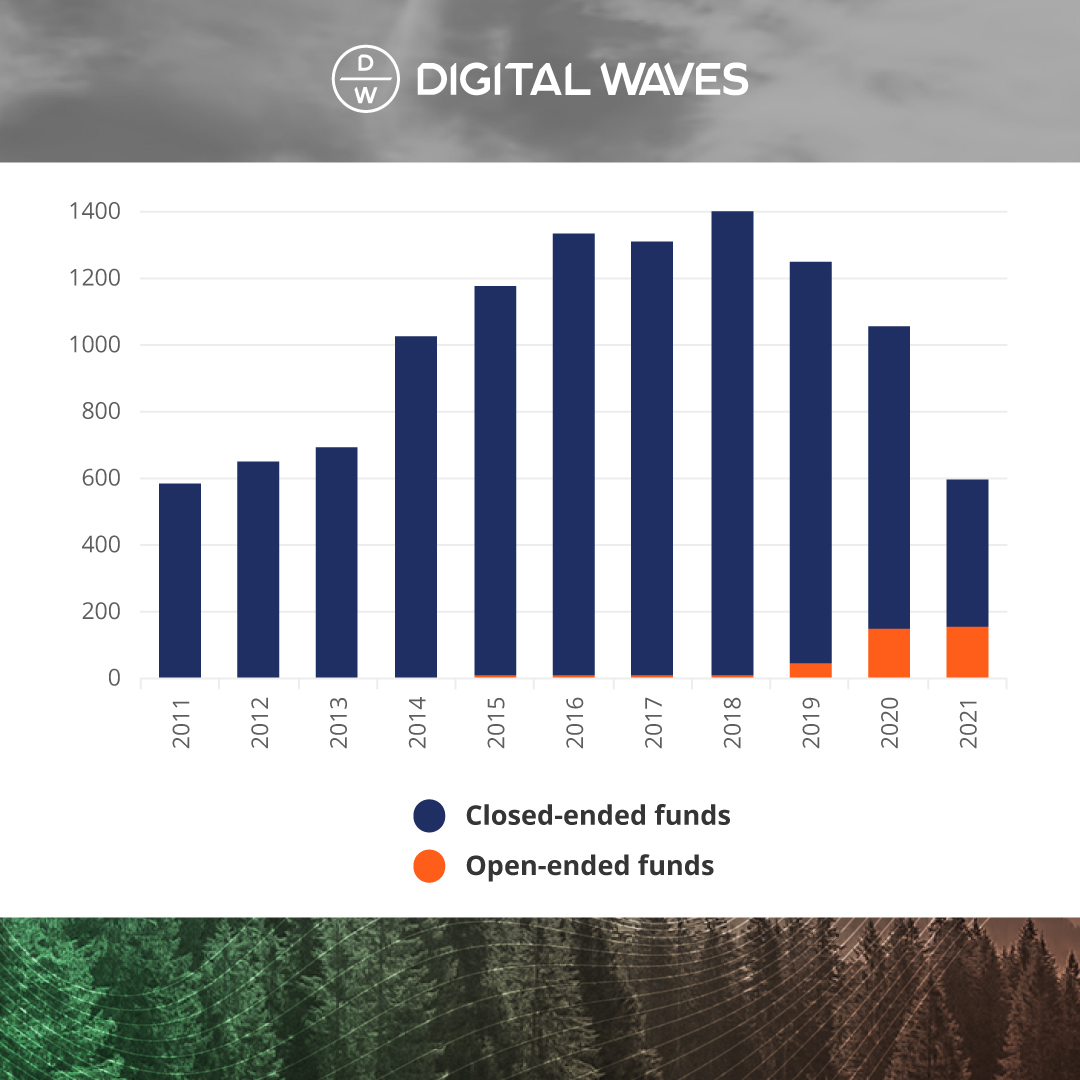

But we see not only an ever broader range of investment vehicles being applied to leverage the value of alternative and digital assets at large. The ratio of closed-end versus open-end vehicles is beginning to shift, particularly when it comes to Venture Capital investments. Over the last decade, VC investors were used to closed-end funds, thus with a lifespan mostly between 7 and 10 years. For five years now, however, there has been a growing number of new open-end VC funds deploying capital [Graph 1].

|

Graph 1: Number of open-end and closed-end VC funds by the vintage year worldwide. [Source: PitchBook].

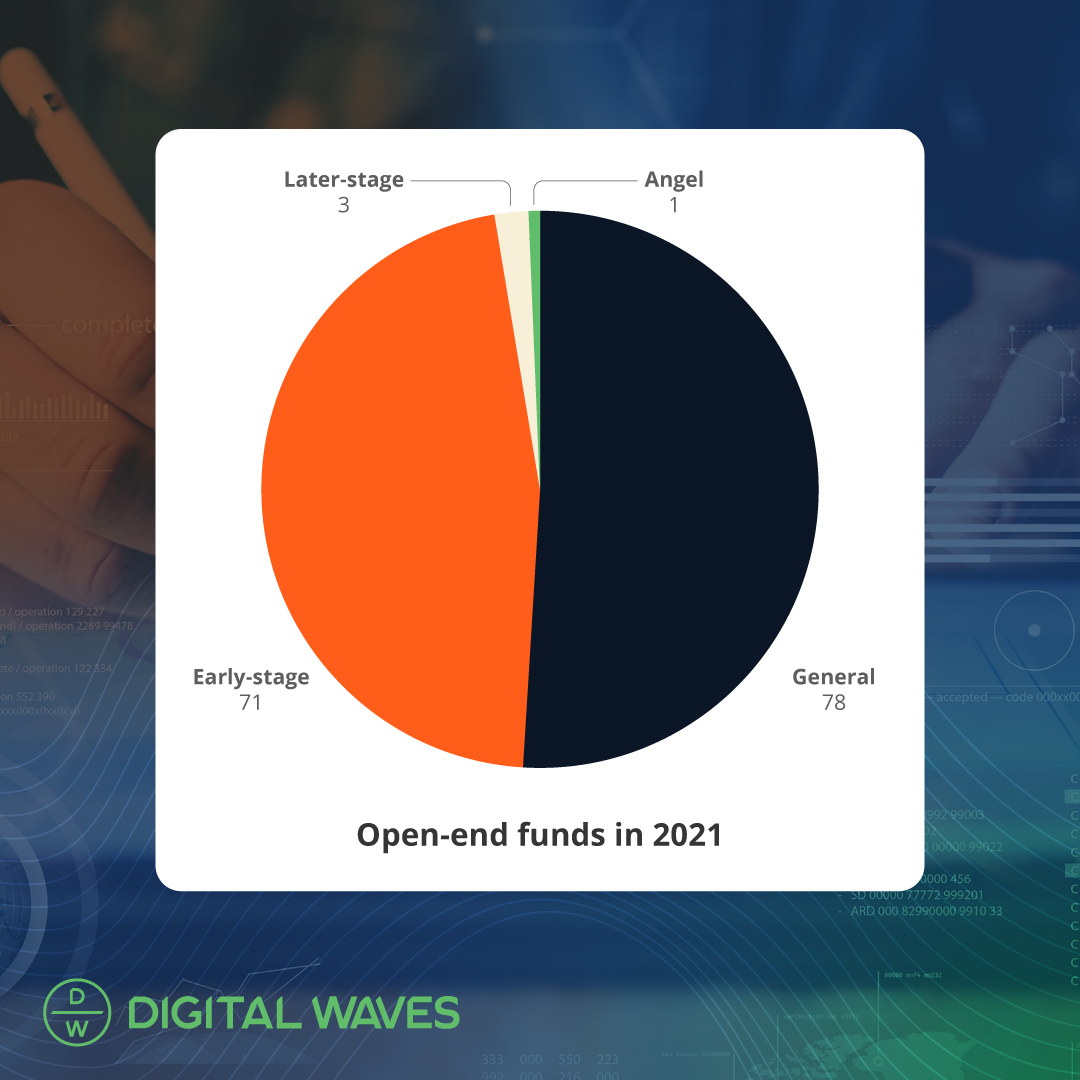

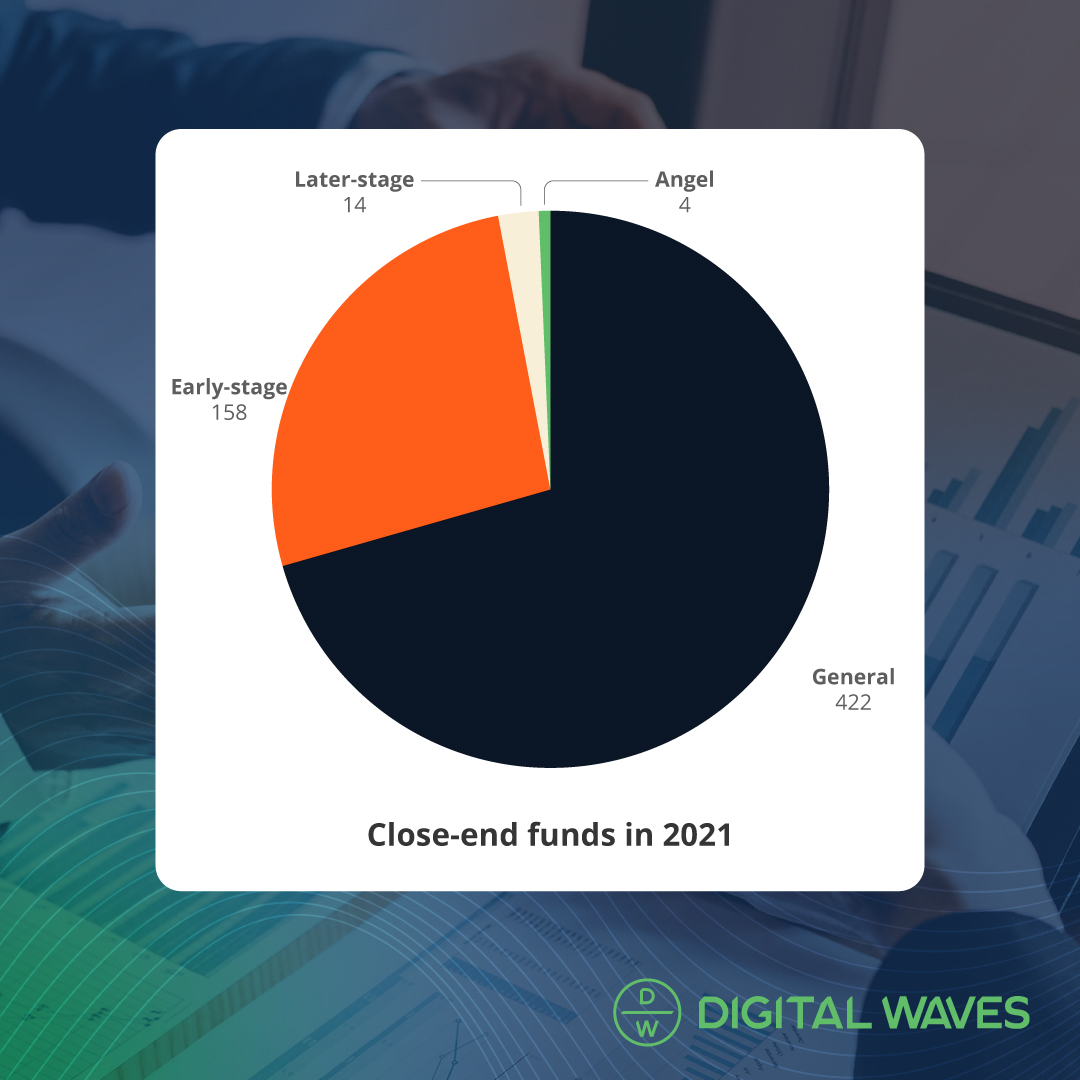

A closer look reveals that a higher proportion of open-end vehicles are used for investments in early-stage companies [Graph 2] than the corresponding proportion of closed-end vehicles [Graph 3]. This indicates the suitability of open-end setups for early-stage investments in particular and reflects the trend toward long-term strategies in this area, especially since successful exits are taking increasingly longer [PwC Switzerland].

|

|

|

| Graph 2: Focus of open-end VC funds in 2021. [Source: PitchBook]. | Graph 3: Focus of closed-end VC funds 2021. [Source: PitchBook]. |

This incipient shift can be explained by looking at the advantages of open-end funds. While underlying companies are still in their early stages, the open-end structure brings advantages to both early-stage companies and investors:

- Sustainability: Companies that want to grow their businesses sustainably are more adequately supported. Strategy Managers need to spend less time on fundraising and have more time on doing the right deal and adding greater value to the underlying investment. This means Strategy Managers can focus on capital appreciation without time barriers.

- Predictability: Investors can take a long-term view without having to constantly invest at capital calls.

- Flexibility: Strategy Managers can adapt to market changes and growth in the underlying investments. More freedom to change an investment thesis and focus on other investments.

- Cost transparency: A single budget and set of fees instead of layers of costs that can accumulate in a traditional VC fund.

Those benefits can also be expressed in numbers. According to data from PitchBook, open-end VC funds, while being a niche offering, regularly perform better than their closed-end equivalents. Since 2018 returns have been growing rapidly, exceeding the benchmark performance by 24 p.p on average. [PitchBook]

In 2021 nearly half of open-end, also called evergreen, funds focused on early-stage VC funding, while the number of closed-funds continues to decline with their primary focus on mature companies [PitchBook], this significant shift in strategic approach, has shown no signs of slowing down.

What is Digital Waves’ Disruptive Tech Portfolio?

The SVBS 1 - Disruptive Tech Portfolio of Digital Waves (Switzerland) and SVBS (Silicon Valley) is an Actively Managed Certificate (AMC) that allows participation in the performance of the assets of more than 20+ disruptive companies from various industries and markets.

All startup companies use deep-tech such as Artificial Intelligence (AI), Internet of Things (IoT), and Blockchain. The AMC portfolio mainly consists of the Equity of these companies, but also Tokens, Simple Agreements for Future Equity (SAFE), or Simple Agreements for Future Token (SAFT) may be included.

Why did Digital Waves choose the vehicle of a Certificate and structured it Open-End?

The Certificate (AMC) operates on a Swiss ISIN (International Securities Identification Number) and is therefore easily accessible. It has no lockup or fixed holding period and a relatively low investment threshold, democratizing investments otherwise reserved for large VC funds. Unlike other investment products, AMCs can be launched for an almost unlimited range of investment strategies and as seen above, special underlying as well, in a flexible, timely, and cost-effective way.

But not only the vehicle of the SVBS1 - Disruptive Tech Portfolio as an AMC is innovative - but also the open-end nature of the product. To realize the deep-tech revolution, especially in the digital assets space, and the potential returns that come with it require sustainable financing for the disruptors and a platform that leverages synergies between the innovations.

The portfolio of the AMC is already clear and not a VC ‘blackbox’, it will be constantly adjusted and enlarged, all of this made possible by its open-end setup structure.

We believe that the flexible structure of the AMC, which allows the evolution of the portfolio and thus the creation of synergies between the companies, and the open-end nature, best suits the interests of the predominantly early-stage portfolio companies and investors.

***

Would you like to become part of the Digital Waves & SVBS portfolio of the next generation of tech innovators?

Discover more here

Contact us.

***

Digital Waves is a financial intermediary rooted in the Swiss banking tradition. Our vision is to make innovative assets bankable and provide clients with a gateway to investing in the future economy. We do this by securitizing assets from equity of disruptive start-ups to the latest crypto token through actively managed certificates (AMC) and by providing brokerage of digital assets.

The portfolio is curated by experienced advisors of the Silicon Valley Blockchain Society (SVBS), a US-based 360° strategic advisor for maximizing venture stage portfolio mechanics, and the Digital Waves network, together forming the Advisory Committee. The proximity to the companies also allows it to provide constant updates and reporting to investors.